Exclusive Featured Products

-

Electric Spin Scrubber

$49.00Original price was: $49.00.$37.00Current price is: $37.00. -

Portable Washing Machine

$52.00Original price was: $52.00.$45.00Current price is: $45.00. -

Multifunctional Peeling Knife Tool

$9.76Original price was: $9.76.$6.74Current price is: $6.74. -

Double-side Tableware Brush

$5.49Original price was: $5.49.$3.99Current price is: $3.99. -

7-Piece Makeup Sponge Set

$38.00Original price was: $38.00.$30.00Current price is: $30.00. -

Crystal Makeup Brushes Set

$14.00Original price was: $14.00.$10.00Current price is: $10.00.

Explore the Collection

Luxury Beauty Products

-

Waterproof Makeup Bag

$15.00Original price was: $15.00.$12.00Current price is: $12.00. -

Electric Makeup Brush Cleaner

$27.00Original price was: $27.00.$20.00Current price is: $20.00. -

Professional Makeup Brush Set

$37.00Original price was: $37.00.$30.00Current price is: $30.00. -

Crystal Makeup Brushes Set

$25.00Original price was: $25.00.$17.00Current price is: $17.00. -

Crystal Makeup Brushes Set

$14.00Original price was: $14.00.$10.00Current price is: $10.00. -

Makeup Brushes Foundation

$14.00Original price was: $14.00.$10.00Current price is: $10.00.

Cleaning Made Easy – Explore Now

-

Powerful Handheld Vacuum Cleaner

$22.00Original price was: $22.00.$15.00Current price is: $15.00. -

Household Cleaning Brush

$16.00Original price was: $16.00.$12.00Current price is: $12.00. -

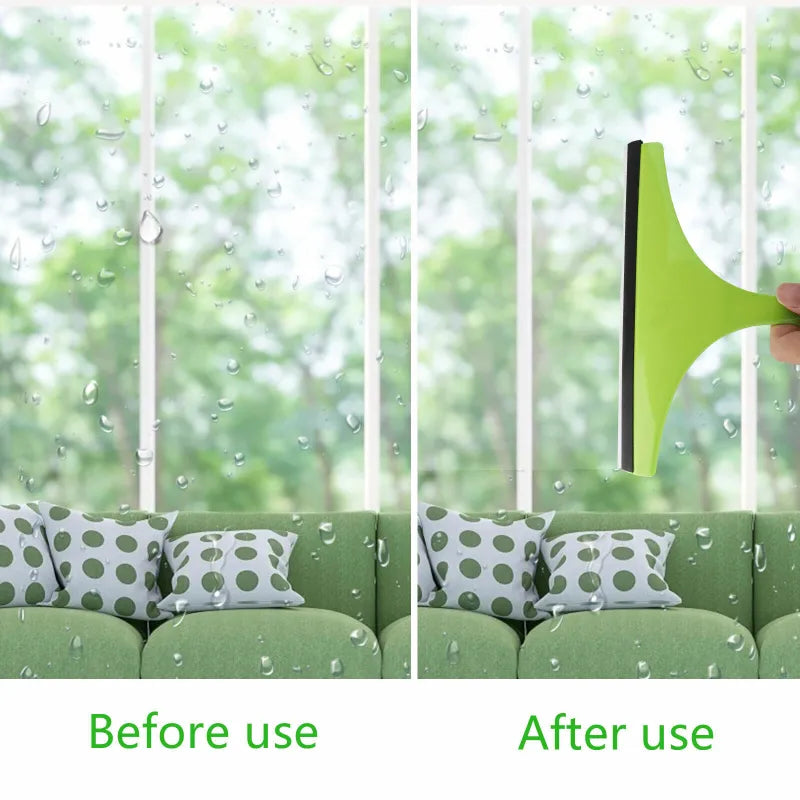

Desk Window Glass Cleaner

$15.00Original price was: $15.00.$10.00Current price is: $10.00. -

Solar Panel Cleaning Brush Kit

$45.56Original price was: $45.56.$33.09Current price is: $33.09. -

Robot Vacuum Cleaner

$120.00Original price was: $120.00.$64.00Current price is: $64.00. -

New Window Cleaner Robot

$217.00Original price was: $217.00.$100.00Current price is: $100.00.

Your Kitchen, Your Way

-

Stainless Steel Fruit Digger Fruit Ball

$10.77Original price was: $10.77.$7.86Current price is: $7.86. -

Stainless Steel Apple Triangle Push Knife

$18.90Original price was: $18.90.$12.40Current price is: $12.40. -

Multifunctional Egg Cutter Stainless Steel

$12.60Original price was: $12.60.$6.87Current price is: $6.87. -

Double-side Tableware Brush

$5.49Original price was: $5.49.$3.99Current price is: $3.99. -

30/20/10/5/1PC Pot Dish Wash Double Side Sponges

$9.99Original price was: $9.99.$7.46Current price is: $7.46.